Peter Lynch with an introduction by Andrew DeWit

Peter Lynch, an expert on the renewable energy sector, offers a concise introduction to the central role of feed-in tariffs (FITs) in fostering the ongoing transition from conventional, carbon-laden sources of generating electricity to renewables such as solar, wind and geothermal. As the author points out, FITs guarantee markets and prices for renewable power, and drive down their cost through deployment and the encouragement of yet more technical advance. FITs thus offer much hope to a world that seems unable to reach any sort of global agreement on cutting emissions which have continued to spiral since the 1997 Kyoto Protocol.

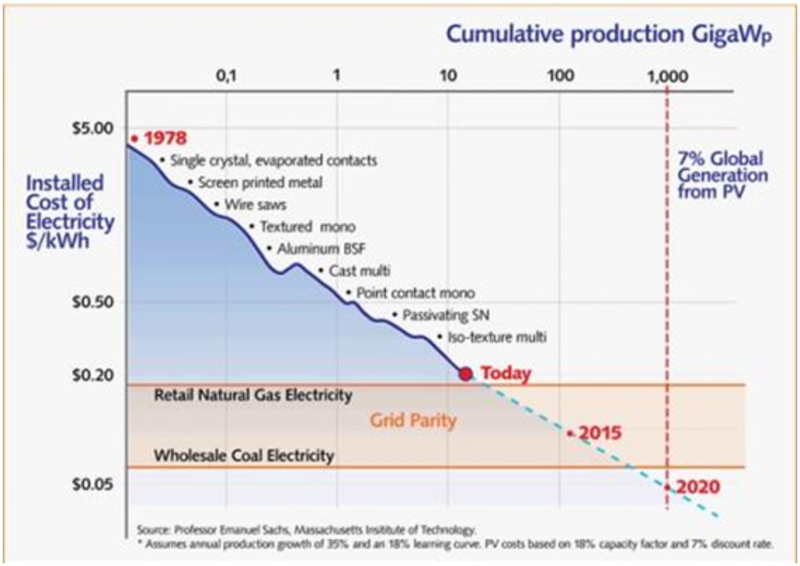

Projected photovoltaic energy costs |

Last year, according to figures from Bloomberg New Energy Finance (link), investment in new generation capacity from renewable energy sources (excluding hydro) totaled USD 187 billion, outpacing the USD 157 billion new investment in natural gas, oil, and coal-fired generating capacity. This rapid ramping up of deployment of existing technologies is key for renewables, as Bloomberg notes. For example, since the mid-1980s each doubling of wind generation capacity has led to a 14% reduction in cost through technical improvements in production, better materials, learning by doing, and the like. Advances have come so rapidly that the Bloomberg New Energy Finance researchers "expect wind to become fully competitive with energy produced from combined-cycle gas turbines by 2016 in most regions offering fair wind conditions."

The article highlights the role of the German FIT in driving this energy revolution. It notes that a decade ago Germany targeted a 12.5% share of electricity from renewables for 2010, but blew through the target in 2007 to achieve a 15.1% share.

The FIT cost the Germans EURO 3.2 billion in 2008, but the German Federal Ministry for the Environment calculates that the FIT saved Germany EURO 7.8 billion in fossil and nuclear fuels and the public health and other external costs from carbon emissions, air and water pollution, and the like by EURO 9.2 billion. The article notes that China and a number of other constituencies have or are introducing FITs and laments that the same is not being down at the federal level in the United States.

The article, being brief and to the point, does not feature the Japanese case. Our readers will know that Japan introduced a FIT in November of 2009, and on August 26 voted in a new and expanded FIT that will come into effect on July 1 2012. This FIT is encouraging a rapidly expanding volume of renewables investment inside Japan from co-ops and farmers, households and local communities through to such heavyweights as Softbank, NTT, and Marubeni as well as overseas giants including Germany's Siemens and China's number 2 PV producer JA Solar. The FIT thus poses a significant threat to the "nuclear village" utilities that in the wake of Fukushima are desperate to protect their expensive and dangerous assets from becoming stranded. The utilities have the enthusiastic support of much of the major business lobby Keidanren, its executive ranks overweight with the utilities themselves as well as financial and manufacturing firms that bet heavily on nuclear becoming the main pillar of Japan's power generation (prior to 3.11, it was scheduled to become 53% by 2030). Through a robust FIT, a significant share of Japan's highly monopolized and relatively high-emissions YEN 16 trillion power market could be lost to a decentralized and renewable-centred power economy.

A key issue is the premium price paid for solar, biomass, wind and other renewables. The higher the price paid by consumers, the greater investment and deployment is encouraged. Too high a price would initiate a bubble, of course, hence caution is advised in targeting an "internal rate of return" that is sufficient incentive for significant and rapid deployment but not so much that it exceeds power needs and the means to use the installed capacity. But too high a price is not on the radar. The real risk in Japan is that prices will be set too low so that little deployment is encouraged. This would blunt the incentives of the world's third-largest economy to lead the energy transition, at the same time driving down its own power costs and externalities as well as those for billions elsewhere, especially in Asia and Africa. This risk is due to the nuclear village having managed to get its people named to the committee that is to set prices. As Japan's Institute for Sustainable Energy Policies (ISEP) warns in a November 24 press release, these individuals include Shindo Kosei, Executive VP of Nippon Steel and head of Keidanren's Global Environment Division. ISEP's discussion of Shindo and his compatriots' backgrounds shows them to be major figures in the clique that devised the policies that led to Japan's current very low level of renewables and over-reliance on nuclear and other unsustainable power sources. Their suggested appointment to the FIT price-setting council is an indication of the continuing strength of the nuclear village in Nagatacho and Kasumigaseki, the political and bureaucratic centres of the central government. This ongoing fight over structuring the FIT is part of the larger fight between renewables and nuclear as the pillar of Japan's power economy, a fight the November 18 New York Times understands to be a "contest over the future of Japan itself."

The International Energy Agency declares that we have 5 years to start cutting emissions, or risk being driven into an uncontrollable acceleration of climate change. The IEA and other agencies' most recent studies also suggest that unconventional natural gas is very risky, carbon capture and storage dead in the water, and highly polluting coal an increasing source of power. The "wedges" for getting our emissions down keep getting fewer and thinner even as our understanding of the pace and scale of the climate challenge suggests ever more daunting challenges. Hence the FIT is a big deal indeed, and what happens with Japan's FIT in the here and now is of deep concern for us all.

Feed-in Tariffs: The Proven Road NOT Taken…Why?

Peter Lynch

America needs to introduce a nationwide feed-in tariff (FIT) to kick-start the renewable industry, restore America's leadership role, and accelerate the expansion of the renewable industry worldwide.

Why is a FIT critical?

Current world energy use is approximately 16 trillion terawatts (TW) per year. According to the BP Statistical Review of World Energy 2008, the amount of direct solar energy that arrives on Earth during an average four-week period is roughly 1,853 TW/yrs., which is greater than the total remaining reserves (1,755TW/yrs.) of all fossil fuels. The numbers speak for themselves and the technically feasible (at this time), long-term solution is renewables.

Given the overwhelming supply advantage and renewable nature of solar energy, we should accelerate the worldwide development of renewables as quickly as possible with a nationwide FIT.

What is a FIT?

A FIT is a policy mechanism designed to accelerate investment in renewable energy technologies. Producers of renewable energy are paid a set rate for the electricity they produce, usually differentiated according to the technology used (wind, solar, biomass, etc.) and the size of the installation. It achieves this by offering long-term contracts to renewable energy producers, typically based on the generation cost of each of the different technologies.

For example, if a PV system is installed on a home in Germany it would initiate a FIT program. This creates a reciprocal energy agreement with your utility — the utility would buy the power you produce at whatever the FIT rate was at the time of the agreement for a period of 20 years. You then buy any additional power (mostly at night) from the utility. Since the FIT price is higher than the retail power price, this arrangement allows you to get a stable return on your investment and makes any borrowing of money very easy.

Why do we need to implement a FIT, and what are the benefits of a FIT program?

1. The FIT concept is proven, as it has worked far above expectations in Germany for the past 10 years. Germany set a 2010 target of 12.5 percent share of renewable energy in electric generation in 2000. They surpassed that goal in late 2007 with 15.1 percent share. That exceeded their schedule by two years and 20 percent — and Germany receives half the amount of sunlight as the U.S. on average.

2. FIT’s pay for themselves in less than one year, in 2008 Germany expended €3.2 billion for its national FIT program. The German Federal Ministry for the Environment calculated its return as follows:

- €7.8 billion from reduced amounts of fossil and nuclear fuels purchased

- €9.2 billion saved from the avoidance of external costs External costs are those that the German government calculates to take account of the avoided costs of using renewables verses fossil fuels such as: damage resulting from climate change, health related costs related to air pollution and toxic wastes, costs of cleanup of rivers and other bodies of water as a result of pollution etc. In the U.S., we ignore these external costs, and fail to include them in project or technology analysis. Ignoring these external costs will be a huge long-term negative for the taxpayer and will result in a significant burden for the U.S. taxpayer who will eventually get “stuck holding the bag” and paying many times over for the problem — long after it should have been properly accounted for and dealt with.

3. FITs do not depend on taxpayer contributions (it is not a subsidy) and no new public debt is needed to fund it, which is ideal in the current recession environment. As a result, a FIT program is not as vulnerable to the uncertainty and unpredictability of the political environment.

4. The FIT has proven superior to any other program currently in use around the world, such as subsidies with public money, tendering models and quota models. In fact, since the German’s have launched their FIT program, approximately 35 to 40 counties have followed suit and implemented their own.

5. FITs eliminate uncertainty thereby encouraging private investment, which results in more taxable income from new companies and jobs in the industry. Remember: where widespread uncertainty exists, major investment does not. This is a basic financial concept that the U.S. has failed to understand and address.

6. FITs dramatically reduces government bureaucracy, eliminate red tape and move the process along at a much faster and cheaper rate. Typical power purchase agreements in the U.S. are incredibly complex and require an army of lawyers and engineers — which is both timely and costly for developers/owners.

7. In the U.S. the typical agreement between a producer and a utility is a minimum of 85 to 100 pages long, in Germany the comparable contract is only two to four pages. The more complex system is not working very well in the U.S., while the simple, transparent system is proven and has been successful for over 10 years in Germany.

8. FITs, by accelerating the development of the renewable energy industry, enhance national security by lessening U.S. dependence on foreign oil and helping to decrease the huge cash drain (approximately $800,000,000 per day in 2010) from buying foreign oil.

FITs proven and working worldwide

FITs must be carefully designed in order to work effectively. Germany has a 10-year-old model others can reference, and 35 models have been based from it worldwide. Some countries have designed their FITs successfully, and some have not. However the U.S. can learn much from these successes and failures. The most recent, closest and successful of these FIT programs is in the province of Ontario, Canada.

FITs are not theories, nor are they the next Solyndra.

Opposition to FITs: Opposition is talk, FITs are fact

FITs major opponent is the local electric utility. These utilities argue that FITs work contrary to the market, but most utilities are not market-driven. They are monopolies — monopolies do not respond to market forces. As history has shown, the last thing a monopoly wants is competition in the market. But if one looks at FIT results, especially in another developed country like Germany, the numbers speak for themselves. FITs are far more market-oriented than monopolies.

There is a lack of political courage to try something new or allow something that powerful contributors (utilities, fossil fuel companies) do not want to infringe on their businesses and help kick-start a competing industry.

Why is it working in Germany and not in the U.S.?

The primary reason FIT’s are working in Germany and not in the U.S. is the respective mindsets in each of the countries.

Germany:

Here are two quotes from Willi Voigt, former minister of the German state of Schlexwig-Holsteim, one of the early adopters of FITs.

“We decided we will reduce the CO2 until 2020, 40 percent, [and by] 2050 by 80 percent. Then we debated the instruments that could make this possible and decided on feed-in tariffs.”

“I hear arguments (spoken in 2009) we discussed in Germany 10 or 15 years ago. It’s the same debate. In Germany, we made a decision; we made a law….the renewable Energy Resources Act (FIT). It worked. You can see the results.”

United States:

1.The German’s made a decision that would benefit their citizens and then followed through. The U.S. can’t make a decision — every U.S. President since Richard Nixon has recognized the unsustainable path we are on and has vowed to move toward less oil-dependence. Since those first “vows” our dependency has more than doubled.

2.Opponents of renewables have done a great job in the media to dampen energy awareness and its solution (FITs) from widespread dissemination among the American people. I believe that the majority of the citizens in the U.S. are not aware of our energy problem and how truly serious it is.

3.Americans, it seems to me, have always been reactive (at least in the energy area) and the current situation calls for us to be proactive. We seem to be unable to make that transition.

Complacency is always a barrier to change. Just as the captain and crew of the Titanic became complacent when the ship was deemed “unsinkable,” we must not become complacent and ignore what is transparent, proven and obvious: feed-in tariffs.

Interesting “coincidence” in China

In closing, I think it is interesting to note that in 2006 China avoided implementing a FIT because “FITs trigger such rapid market growth,” according to an unnamed Chinese official. I would certainly view this as a compliment to the effectiveness of a well-designed FIT. Perhaps the Chinese realized that their solar manufacturing base was not in place to address this potentially explosive market?

In 2011 the Chinese implemented a FIT program, their domestic market is now booming and coincidently, Chinese solar manufacturing has scaled up to the point where they can address this huge market without the help of imports. According to the Global Trade Atlas, in 2006 China was 12 percent of the world export (12 percent of 20.3 billion = $2.4 billion), and in 2010 they were 33 percent of the world export market (33 percent of 76.1 billion = 25 billion). In reality, since the prices were much lower in 2010 the unit volume growth was far more than five-fold.

Andrew DeWit is Professor of the Political Economy of Public Finance, School of Policy Studies, Rikkyo University and an Asia-Pacific Journal coordinator. With Kaneko Masaru, he is the coauthor of Global Financial Crisis published by Iwanami in 2008.

Recommended citation: Peter Lynch and Andrew DeWit, 'Feed-in Tariffs the Way Forward for Renewable Energy,' The Asia-Pacific Journal Vol 9, Issue 48 No 3, November 28, 2011.

Courtesy of The Asia-Pacific Journal: Japan Focus

No comments:

Post a Comment